Colombus publishes its 7th study on the digitalization of the customer experience in Swiss retail banking:

- Retail banks’ mobile applications are increasingly updated and appreciated, with an NPS up 5 points (67%),

- Digital marketing budgets are up 23% to over 58 million Swiss francs annually,

- Engagement on social networks has jumped by 64%, with almost 100,000 interactions per month,

- Notable AI initiatives, with banks such as UBS using AI assistants to analyse data for mergers and acquisitions.

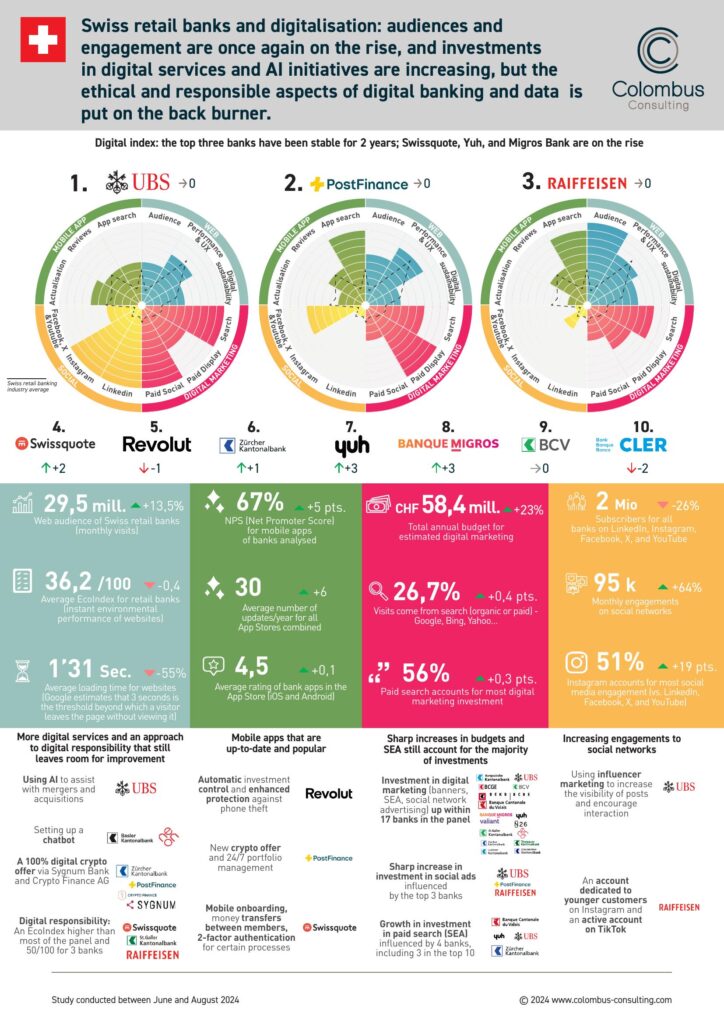

A podium that has remained unchanged for 2 years

The same banks will close the top three in the ranking by the end of 2024: UBS, PostFinance, and Raiffeisen. Crédit Suisse’s departure from the panel and Swissquote’s progress in the web and mobile app segments mean that this digital bank is now right on the heels of this trio. Other banks making progress include Yuh and Migros Bank, which are ranked 7th and 8th respectively.

Efforts being made on the digital front are evident across the board. Web audience grew overall by 13.5% (almost 30 million monthly visits), investment in digital marketing remained strong (+23%, or more than 58 million Swiss francs annually), the NPS for mobile apps rose by 5 points (67%) and engagement on social networks jumped by 64% to reach a total of almost 100,000 monthly interactions.

Websites are being driven by customer experience and digital products

Optimising customer experience remains a warzone – with BCF, N26, and Neon deploying new web analysis tools to achieve this purpose, and BKB and Neon developing direct contact via chatbot. Digitalisation also involves digital offers and access to crypto-currencies for PostFinance and ZKB, in the same vein as the cantonal banks of Lucerne, St Gallen, and Zug, through partnerships with banks specialising in this type of asset (Sygnum Bank, and Crypto Finance AG).

More popular mobile apps and more services for security

Banks’ mobile apps have been very successful this year. The NPS level has risen by 5 points to 67%, and the number of updates per player is also on the rise, with an average of 30 updates – 6 more than in 2023. However, there is still a split between neo-banks and traditional banks (64 updates compared with 24). The most innovative new services are demonstrated by the neobank Revolut, thanks to automatic investment management and enhanced protection against phone theft. Swissquote is also focusing on security, with 2-factor authentication for sensitive transactions.

“Banks’ digital products are continuing to develop, driven by mass adaptation, revamped customer experience, and smartphones, which remain the universal screen used by clients,” says Jean Meneveau, Associate Director of Colombus Consulting Switzerland.

Social networks: engagement driven by Instagram and LinkedIn

Social networks’ reach is less significant this year, with the number of subscribers down by 26% (2 million in total), due to Crédit Suisse’s and FlowBank’s absence from the panel and the Facebook’s decline.

Engagement, meanwhile, is on a roll, up 64% thanks in particular to Instagram and LinkedIn, reaching almost 100,000 interactions per month. Content is more visible and encourages likes, comments, and shares from subscribers, thanks in particular to influencer marketing at UBS with a well-known Formula 1 team and driver George Russell.

Raiffeisen, for its part, has opted for the youngest group of individuals who are active on social networks, with an Instagram page dedicated to them and an active and engaging TikTok account – generating over 700,000 and even 800,000 views on certain videos.

Is (generative) AI taking over Swiss banks?

While private banks such as Pictet and Vontobel have recently paved the way to working with AI by using assistants based on generative AI to optimise their internal productivity and client interactions, UBS is following suit with its AI assistant – developed in-house over the past 12 months to analyse company data for mergers and acquisitions.

Temenos, the Swiss banking solutions provider, is now offering a range of solutions enhanced by generative AI. As a result, its client banks can generate unique information and reports or create products in real time according to customer preferences to support core banking activities and the most critical commercial functions. In the same vein, other general-purpose publishers such as Oracle, Salesforce, and Microsoft have enhanced their solutions with generative AI modules to increase their functions available, while maintaining strong business logic.

Digital responsibility technology is still in the making

Integrated into our digital index last year, Digital Responsibility measures the environmental impact of the websites belonging to the banks in the panel by analysing their complexity, weight, and number of HTTP requests. The mixed results seen in 2023 remain valid in 2024, with the EcoIndex average remaining virtually stable at 36/100.

Swissquote alone remains well ahead of the other banks – with an excellent score of 95/100. However, CA Next Bank and LUKB have also made good progress, although they did not manage to break the 50/100 barrier; this didn’t offset the falling scores of some of the other banks, such as BCV, N26, and, Yuh. It remains to be seen whether banks will make responsible digital banking more central to their digital strategies in the coming months.

Moving towards a more ethical and responsible way of banking?

Ethical and responsible business practices are developing on all fronts, particularly in regulatory areas in Europe (and undoubtedly in Switzerland in the longer term), with the Corporate Sustainability Reporting Directive (CSRD) and the AI Act leading the way. As a reminder, the CSRD requires companies to provide detailed non-financial reporting on their environmental, social, and governance impacts, and therefore to take action in these areas, while the AI Act requires AI systems to be classified by risk level, with obligations depending on their use. Swiss banks are not all in the same boat: international banks within European zones must follow these directives; even others, which are more local, will eventually be affected.

“There are many frameworks and tools available to banks, but there still seems to be a long way to go to meet all of the challenges of ethical and responsible banking,” concludes Brewen Latimier, Manager at Colombus Consulting Switzerland.

Digital Index: the sector’s overall digital performance

Below, Colombus Consulting presents the rankings of the Digital Index, which measures the digital performance of retail banks based on 50 indicators divided into four areas: Web, Mobile, Marketing and Social.

Methodology

We based this study on measurements taken between June and August 2024, on a panel of 28 major players in the retail banking sector:

Traditional banks: Banque Migros, Crédit Agricole Next Bank, PostFinance, Raiffeisen, Valiant, UBS,

Cantonal banks: Aargau, Basel, Bern, Fribourg, Geneva, Graubünden, Lucerne, Schwyz, St. Gallen, Thurgau, Valais, Vaud, Zurich

Digital banks and neo-banks: Cler, Dukascopy, N26, Neon, Revolut, Swissquote, Yuh, Fea Money, Yapeal

We offer a digital index to measure the 360° digital presence and performance of players according to more than 50 indicators:

- Website: audience, performance (bounce, visit time, loading time, core web vitals), customer experience (design, content and functions) and digital responsibility (EcoIndex)

- Mobile apps: updates, comments and ratings, NPS (Net Promoter Score), referencing in stores

- Digital marketing: SEO, display, email, social networks and partners

- Social networks: Instagram, LinkedIn, Facebook, Youtube, X (ex-Twitter)

Solutions used

We used various market data collection tools, and reworked all the data in the form of an index for a simple, visual benchmark of the sector. The chosen solutions are : Decodeapps, Similar Web, Semrush, Built with, Google, Page Speed Insights, EcoIndex.

To find out more, see our Banking and Customer Value offers.