An enhanced mobile and social experience, AI and TikTok at the heart of customer engagement, and limited product innovations but growing digital proximity and responsibility.

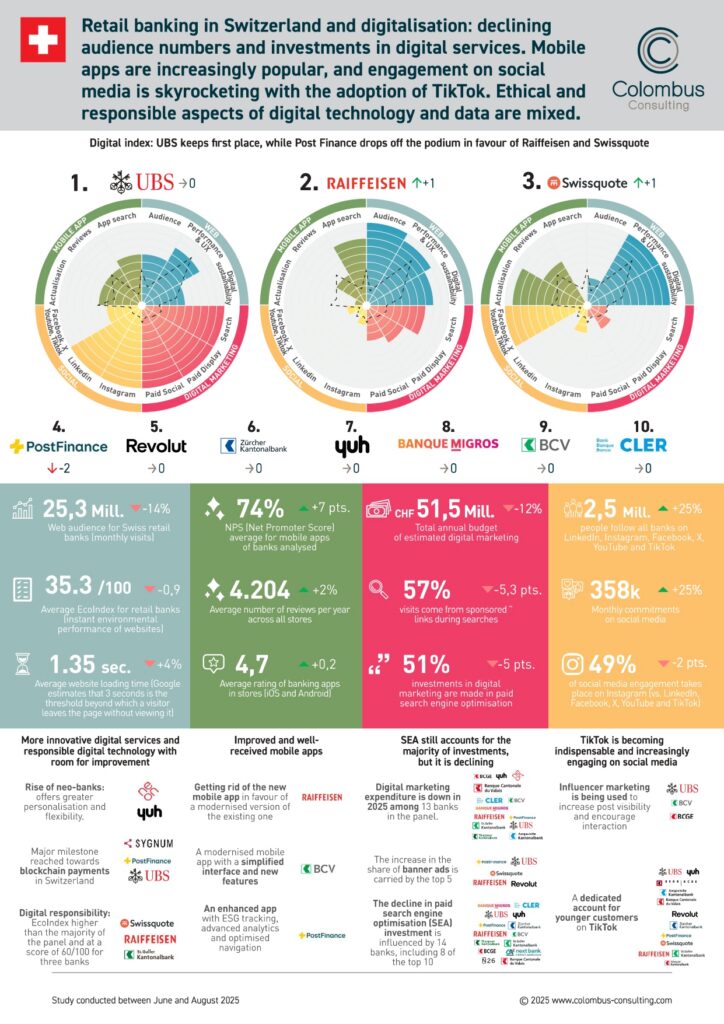

The 2025 edition of this study confirms the growing maturity of digital banking in Switzerland, while also revealing its paradoxes. Banks are consolidating their achievements – particularly in mobile apps and social media – and refocusing their investments and priorities. While UBS, Raiffeisen and Swissquote embody the success of a controlled transformation, the overall decline in web audiences and digital budgets reflects a change in cycle, with a shift towards customer value rather than technological one-upmanship.

The ranking is largely dominated by UBS, with Swissquote and Revolut lying in wait

UBS has retained its top spot thanks to a solid digital strategy combining marketing excellence and visibility on social media. Raiffeisen is gaining ground and coming out on top in the web category, while PostFinance is falling behind, penalised by more mixed performances in the social media and digital responsibility categories. Among the banks making progress, Swissquote has confirmed its momentum thanks to innovation and a strong commitment to responsible digital technology, while Revolut has maintained its position thanks to the power of its mobile ecosystem. The2025 podium illustrates the growing maturity of banks combining performance, innovation and responsibility.

The websites are very extensive, perhaps too extensive, as 40% of visits are made from a mobile device

Swiss banking websites remain among the most comprehensive in the sector, but their dense content raises questions in the face of increasing mobile usage. Over the course of 2025, 40% of visits have been made from a smartphone. These new codes and practices, which banks have not yet mastered, have resulted in a 14% decline in measured web traffic on average. Beyond traffic, the time spent on each page has also fallen by 50%.At a time when attention spans are shrinking, our study shows that website loading times are becoming a major source of customer dissatisfaction.

Banks are also rebalancing their digital budgets, with a decline in SEA (-21%)and increasing their share of display and social media.

Belated acceleration in the development of mobile apps by taking customers into account

The mobile branch has become the cornerstone of banking relationships. After years of adjustments, institutions such as BCV and Postfinance are opting to modernise their existing apps. Simplified interfaces, ESG features and personalised analytics reflect a more customer-centric approach. These efforts are being rewarded with positive user feedback and confirm the central role of the mobile branch in customer loyalty and experience.

TikTok is becoming a key channel for the financial education of younger generations

Social media is experiencing strong growth, driven by the rise of TikTok. More and more banks such as AKB, BEKB, Raiffeisen and UBS are developing accounts dedicated to young customers, combining influence, education and engagement. This strategy illustrates the evolution of banking-related marketing towards more authentic and participatory formats. At the same time, LinkedIn and Instagram remain the leading platforms in terms of engagement, generating the most likes, comments and interactions, and enabling banks to strengthen their credibility and visibility among their established communities. Social media is thus becoming a key lever for raising awareness, building proximity and modernising the image of Swiss banks.

After the crypto wave, there was a lack of new products or services…

The excitement surrounding digital assets observed between 2021 and 2024 is giving way to a phase of consolidation. Swiss banks, although ahead of the curve in integrating blockchain and decentralised payment solutions, are now prioritising reliability and compliance over disruptive innovation. Few new services emerged in 2025, apart from a few pilot initiatives on tokenised payments and fractional investing led by PostFinance and UBS, in partnership with Sygnum. This form of caution reflects a desire to stabilise the existing situation after the crypto wave, while laying the foundations for future regulatory and technological developments.

…but customer proximity is being strengthened through cultural events

Faced with a slowdown in the launch of new products and services, banking institutions are strengthening their ties with local customers through high-value relationship-building activities. Sponsoring cultural events, regional partnerships and financial education programmes is on the rise. These initiatives aim to reaffirm the societal impact of banks, modernise their image and maintain a relationship of trust with customers. By combining culture, education and proximity, they seek to compensate for declining engagement with traditional channels and create a more authentic relationship, particularly with younger generations. We are seeing a real difference between neo-banks, which offer an ideal digital experience, and traditional banks, which are strengthening their proximity to their customers.

AI: from a dream to reality?

Artificial intelligence is now establishing itself as a strategic lever in banking models, far beyond its initial experimentation. New-generation chatbots, automated scoring and personalised offers are marking a profound transformation in customer relations. Banks such as UBS, BEKB and Neon have integrated GenAI-powered conversational assistants to improve service and responsiveness. However, growth remains mixed: initiatives are still focused on operational use cases, far from AI being fully integrated into the customer experience strategy. The challenge for the coming years will be to move from experimental AI to responsible, ethical and measurable AI.

Should we save ESG (Environment, Social, Governance)?

After several years of intense communication on sustainable finance, Swissbanks’ ESG commitment is stalling. While some, such as PostFinance, now incorporate sustainability indicators directly into their mobile apps, consistency between words and actions has room for improvement. Regulatory requirements are tightening, but growth gaps remain significant. Responsible digital technology is making progress – with Swissquote, Raiffeisen and SGKB scoring above 60/100 on the EcoIndex – but efforts remain fragmented. The challenge now is to put ESG back at the heart of the digital value proposition. More than just an image issue, it is a real driver of differentiation and trust.

Methodology

We based this study on measurements taken between June and August 2025, on a panel of 28 major players in the retail banking sector:

Traditional banks: Banque Migros, Crédit Agricole Next Bank, PostFinance, Raiffeisen, Valiant, UBS,

Cantonal banks: Aargau, Basel, Bern, Fribourg, Geneva, Graubünden, Lucerne, Schwyz, St. Gallen, Thurgau, Valais, Vaud, Zurich

Digital banks and neo-banks: Cler, Dukascopy, N26, Neon, Revolut, Swissquote, Yuh, Fea Money, Yapeal

We offer a digital index to measure the 360° digital presence and performance of players according to more than 50 indicators:

- Website: audience, performance (bounce, visit time, loading time, core web vitals), customer experience (design, content and functions) and digital responsibility (EcoIndex)

- Mobile apps: updates, comments and ratings, NPS (Net Promoter Score), referencing in stores

- Digital marketing: SEO, display, email, social networks and partners

- Social networks: Instagram, LinkedIn, Facebook, Youtube, X (ex-Twitter) and TikTok

Solutions used

We used various market data collection tools, and reworked all the data in the form of an index for a simple, visual benchmark of the sector. The chosen solutions are : Decodeapps, Similar Web, Semrush, Built with, Google, Page Speed Insights, EcoIndex.

To find out more, see our Banking and Customer Value offers.