Colombus Consulting publishes the 4th edition of its study on the digitalization of private banking customer relationships in Switzerland, carried out with a panel of nearly 30 major players in the sector. The study points out the explosion of AI, driving increasingly rapid change. It’s high time for private banks to gear up for the new digital challenges it brings.

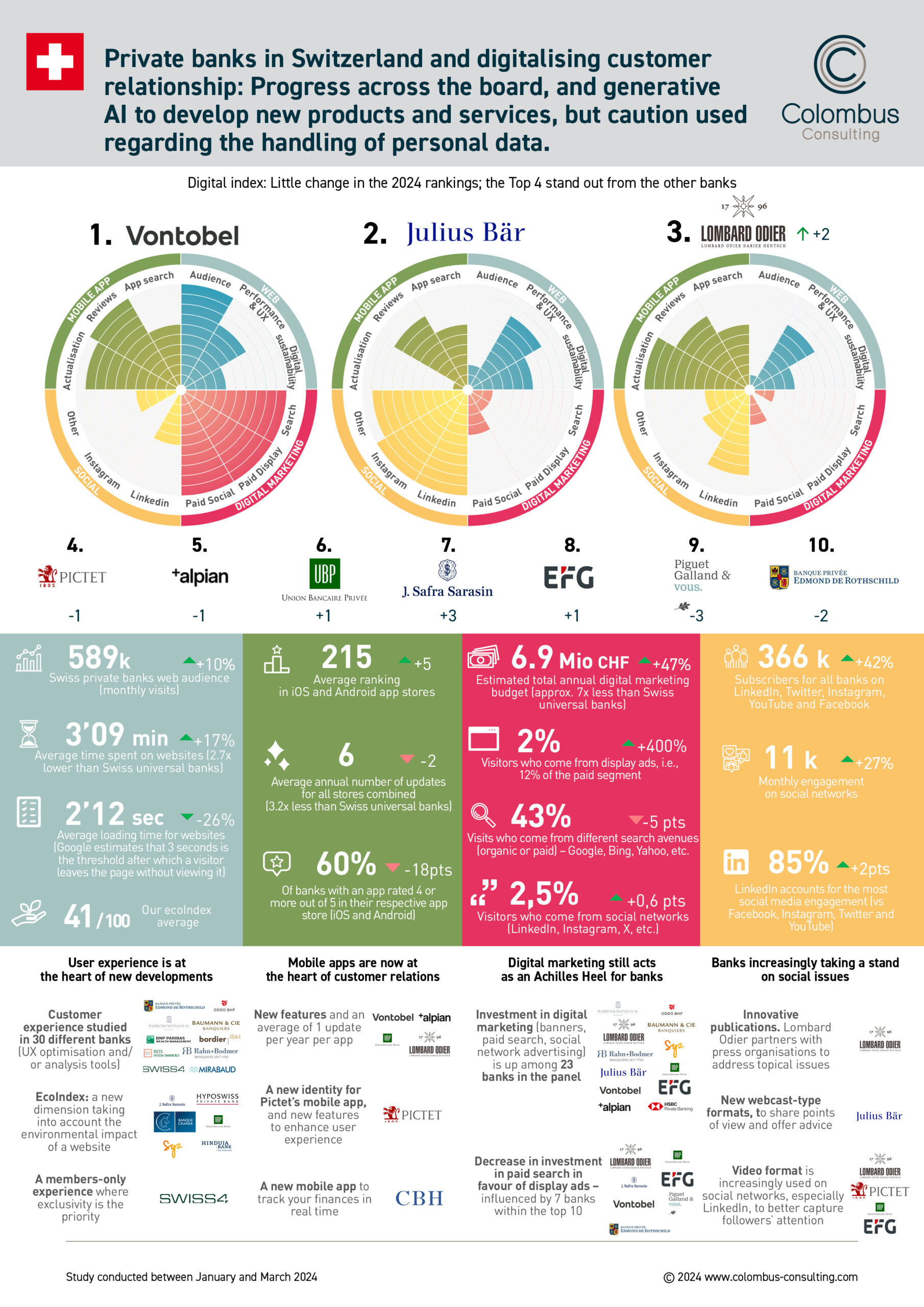

The 2024 ranking remains broadly unchanged, with a Top 5 group that stands out from the rest of the panel

The Vontobel, Julius Bär, Lombard Odier and Pictet quartet dominated the rankings again this year. The high volume of traffic on their websites enables them to benefit from a ‘snowball’ effect across all the dimensions studied, generating natural or paid traffic that redirects customers to their digital platforms (web, mobile, social networks, etc.). Alpian remarkable raise to the top of the ranking in 2023 was confirmed this year, demonstrating the bank innovative and digital character.

In addition to the changes in the rankings, growth in web traffic is positive for the panel as a whole (+10% with almost 590 million monthly visitors) and the various e-banking platforms performances have improved considerably. This is reflected in a more engaged audience (+17%).

However, the banks surveyed still have some way to go in terms of digitalization, particularly when it comes to mastering digital marketing and managing mobile apps, where progress remains slow.

Lombard Odier and Vontobel stand out, however, by offering an app that is regularly updated and highly rated, and new entrants such as Alpian are offering modern features such as in-app video calling.

Social networks: A new era has begun, dominated by LinkedIn

While the number of subscribers on social networks remained stable in 2023, this year, we are seeing growth of 32%. The slowdown on Facebook (+9%) has been more than made up for by LinkedIn (+42%, reaching 77% of the total social network audience), followed by Youtube and Instagram (+20% and +17%). X (formerly Twitter), on the other hand, no longer seems to be attracting any crowds (+0.2%).

In 2024, the appearance of video content presenting banks convictions in terms of market vision and investment attracted a new audience to these media platforms. On the whole, CSR (Corporate Social Responsibility) and ESG (Environmental, Social and Governance) continued to be the themes most frequently addressed in this year content.

The study also highlights efforts to communicate on other themes, such as sport or the banks associative/charitable commitments. Although this type of information attracts a new audience, it generates very little commitment and does not encourage exchange with their communities.

“The quest for interaction with the community is set to intensify and will require banks to develop new types of digital content such as webcasts and white papers. However, these will need to be based on a strategic position that is sufficiently clear and differentiated to be shared publicly,” explains Brewen Latimier, Manager at Colombus Consulting Switzerland.

Digital responsibility: Lagging behind?

Over the last few years, private banks have started to embrace ESG criteria, with sustainable development becoming a key aspect of banking products – particularly funds.

“We have included the notion of digital responsibility in our study, and we can clearly see that private banks have under-invested in this area, while neo-banks are more attentive to it,” adds Jean Meneveau, Associate Director of Colombus Consulting.

Are banks finally ready to make their tools available to customers?

“The arrival of digital neo-banks has definitively changed the way we ‘consume’ banking. Customers are now demanding digital tools throughout their banking experience”. This includes digital services for reporting, placing orders and interacting with their investment manager.

Digital solutions publishers have understood this concept and now offer B2B2C tools that banks can use for their own accounts and make available to their customers (online KYC [Know-Your-Customer], electronic signatures, portfolio simulation and impact analysis, order placement).

New technologies and private banking: moving towards more precise and personalised recommendations

Relationship Managers’ abilities in private banking are being enhanced, which benefit considerably from new technologies that are revolutionising the way in which they interact with their clients and manage their portfolios. Using tools such as portfolio management services, customer relationship management software, e-banking and generative artificial intelligence, they can produce and offer more accurate and personalised recommendations. These types of technology can provide a better understanding of customers (e.g., AirWealth by Avaloq), improved banking services, particularly in terms of simulations and portfolio management (e.g. Swissquant), and faster and better responses both internally and externally. However, adopting these new technologies faces certain hurdles, such as the need to share customer data with third-party tools, respecting banking confidentiality and managing change within financial institutions.

Private banking and AI: Moving towards a new era of efficiency and compliance

Over the past year, many banks have launched AI initiatives with varying degrees of real impact on their operational performance. Pictet got a head start on its competitors with the launch of One.chat (Unique) to optimise its productivity, or the launch of an AI-powered fund to generate outperformance. These use cases show that banks have embraced AI for their internal operations. For the moment, initiatives involving customer data are non-existent, demonstrating that Swiss private banks are still concerned about confidentiality.

Digital Index: The overall digital performance of the sector

We present here the global ranking from the Colombus Consulting Digital Index, measuring the 360° digital performance of the Swiss watch industry according to 50 indicators (web, mobile, marketing and social). The results show very different situations between the players.

Methodology

We have built this study based on measurements taken in the first quarter of 2024 and on a panel of nearly 30 major players in the private banking sector.

Private banks: Alpian, Banque Bonhôte & Cie SA, Banque Cramer & Cie, Bergos, Baumann & Cie, BNP Paribas Private Banking, Bordier & Cie, Compagnie Bancaire Helvétique, Edmond de Rothschild, EFG, Gonet & Cie, Hinduja Bank, Hyposwiss, J. Safra Sarasin, Julius Bär, LGT, Lombard Odier & Cie, Maerki Baumann & Co. AG, Mirabaud, Oddo BHF, Piguet Galland, Pictet & Cie, Reyl Intesa San Paolo, Rahn & Bodmer, Société Générale Private Banking, Swiss4, Syz, Thaler, Union Bancaire Privée, Vontobel

- Website : audience, performance (bounce, visit time and loading, core web vitals), customer experience (design, content and functions) and digital responsibility (EcoIndex)

- Mobile Apps : updates, comments and ratings, NPS (Net Promoter Score), Search (ASO) in the App stores

- Digital marketing : SEO, display, e-mail, social networks, partners

- Social Networks : LinkedIn, Facebook, Youtube, X (ex-Twitter), Instagram

Solutions used:

We used various market data collection tools. We reworked all the data in the form of an index for a simple, visual benchmark of the sector. The solutions we chose were : Decodeapps, Similar Web, Semrush, Built with, Google, PageSpeed Insights, EcoIndex.