The European CSRD (Corporate Sustainability Reporting Directive) has been implemented progressively since 1 January 2024. General changes are to be expected, but the publication of non-financial reports will gradually affect all European companies. What about Swiss companies?

Colombus publishes its 1st study on sustainable finance in Switzerland

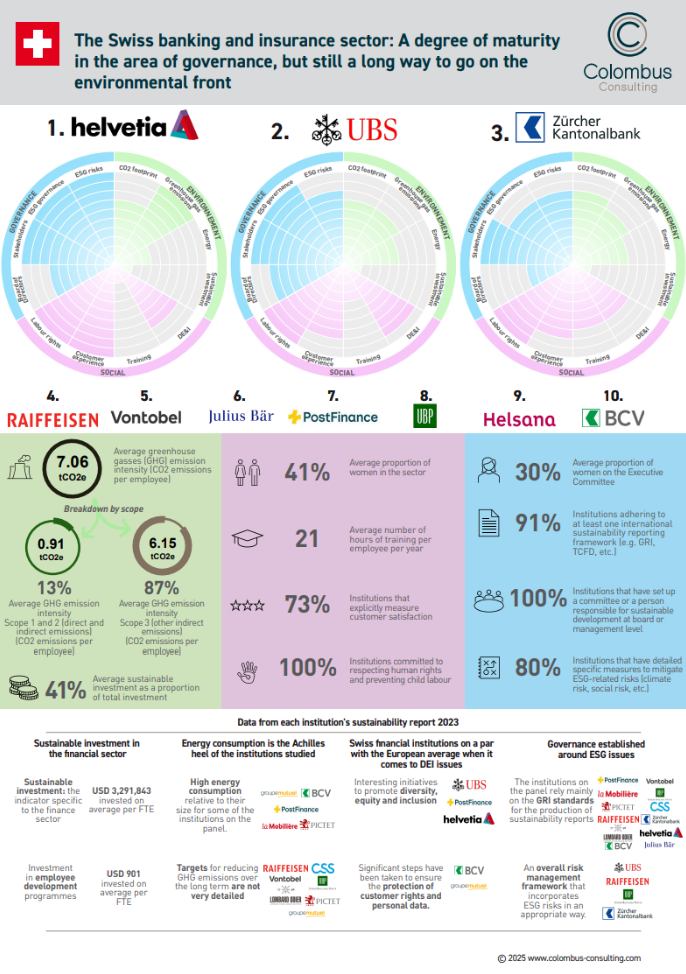

Our analysis highlights the progress made by Swiss financial institutions towards more fully integrating ESG (Environmental, Social and Governance) criteria. While significant progress has been made, there is still a long way to go. Governance stands out as the main driver of this transformation, supported by dedicated sustainability committees that ensure that ESG issues are integrated into financial institutions’ strategies. On the social front, solid diversity and inclusion initiatives are visible, although there is still room for improvement, particularly in terms of taking customer feedback and satisfaction into account, especially in private banking. Overall, the foundations are solid, but efforts must be stepped up to ensure that sustainable finance becomes a reality that is fully rooted in the Swiss business landscape.

Environment: a commitment that can be strengthened

Swiss financial institutions are showing a growing willingness to integrate environmental issues into their strategies. Transparency about the ecological impact of their activities is improving, and the ecological transition is now seen as a strategic opportunity rather than a moral imperative. However, a major challenge remains: banks play a key role in the energy transition through their financing decisions, but their commitment to the fight against climate change remains insufficient.

A WWF report from November 2024 ranks Swiss banks as “average” when it comes to sustainability, pointing to the need for more ambitious action. While ESG investments are taking greater account of climate risks, they are still supporting certain controversial sectors. Biodiversity remains an issue that is often neglected, even though it is essential to any global environmental strategy. Harmonisation of practices and better integration of biodiversity into investment decisions are needed to accelerate this transition.

While some banks, such as Helvetia and Julius Baer, stand out for their transparency and for setting clear targets for reducing greenhouse gas emissions, most institutions in the financial sector still lack detailed strategies. To give credibility to their commitments, they need to define concrete actions and allocate specific resources to achieving their climate ambitions. Finally, strengthening dialogue with stakeholders and integrating their expectations more fully into ESG strategies will be essential to building trust and collective commitment.

Social: diversity & inclusion and customer focus: progress but still a lack of action

Diversity, inclusion and respect for human rights are now well-established pillars of governance in Swiss financial institutions. UBS, Helvetia and PostFinance stand out for their concrete actions regarding this pillar and the commitment of their top management to keep up these principles. However, there is still room for improvement, particularly when it comes to taking external stakeholders into account.

One particularly notable area for improvement concerns customer relationship management, especially in the private banking sector. Although institutions respect the rights of consumers and apply strict protocols for the protection of personal data, there is still a lack of active listening to customers and consideration of their feedback. The lack of public data on customer satisfaction in this segment illustrates this lack of transparency and consideration.

Governance: proven maturity, but gaps still need to be closed

Institutions in the Swiss financial sector have acquired a solid level of maturity in terms of ESG governance. Dedicated sustainability committees rigorously monitor the integration of ESG criteria into corporate strategies, and sustainability reports provide regular data on their performance in this area. However, differences persist from one player to another in the way ESG risks are integrated into overall risk management.

Some institutions, such as UBS, Raiffeisen, ZKB, PostFinance and Helvetia, stand out by integrating these issues directly into their credit assessment and risk management processes, while others are lagging behind. Greater harmonisation and standardisation of ESG risk assessment methodologies would ensure more uniform and effective adoption of sustainable governance principles.

Sustainability and performance: finding the right balance

The integration of ESG criteria into the Swiss financial sector reflects an encouraging dynamic, but it is facing some major tensions. The application of regulatory frameworks such as the CSRD aims to structure sustainability practices, but it is also attracting criticism from some governments and companies who are complaining of high costs and constraints on competitiveness. In addition, growing resistance to certain sustainability policies and the priority given by many clients to financial performance are adding further complexity to this transition.

In a changing international context, where the United States is adopting a more refractory stance under the Trump administration, while China is positioning itself as a leader in the energy transition (while remaining the world’s number one polluter), it is imperative for Swiss banks to strike a balance between sustainability and returns. Innovation can play a key role in this process by demonstrating that responsible investment is not incompatible with long-term competitive performance.

To make this transition a success, it will be essential to strengthen collaboration between regulators, financial institutions and investors, while making stakeholders more aware of the benefits of a balanced approach. It is only by reconciling sustainable commitment with economic requirements that Switzerland will be able to consolidate its role as a leader in responsible finance and meet the challenges of a financial sector in the throes of transformation.

To find out more, take a look at our Banking and Strategy & Innovation offer.