Colombus Consulting publishes the 5th edition of its study on the digitalisation of the customer experience in Swiss retail banking. The study confirms a resumption of the growth of digitalization on various fronts, with a gap that tends to reduce between retail banks and digital banks. However, differences persist, particularly in terms of the functions and customer experience offered, where the neo-banks stand out for their innovation and a mainly digital customer relationship.

Traditional banks: Banque Migros, Crédit Suisse, Next Bank, Neue Aargauer Bank, PostFinance, Raiffeisen, Valiant, UBS

Cantonal banks: Aargau, Basel, Berne, Fribourg, Genève, Grisons, Luzern, Schwyz, St Gallen, Thurgauer, Valais, Vaud, Zürich

Digital banks and neo-banks: Cler, N26, Neon, Revolut, Swissquote, Yuh, FlowBank, Fea Money, Yapeal

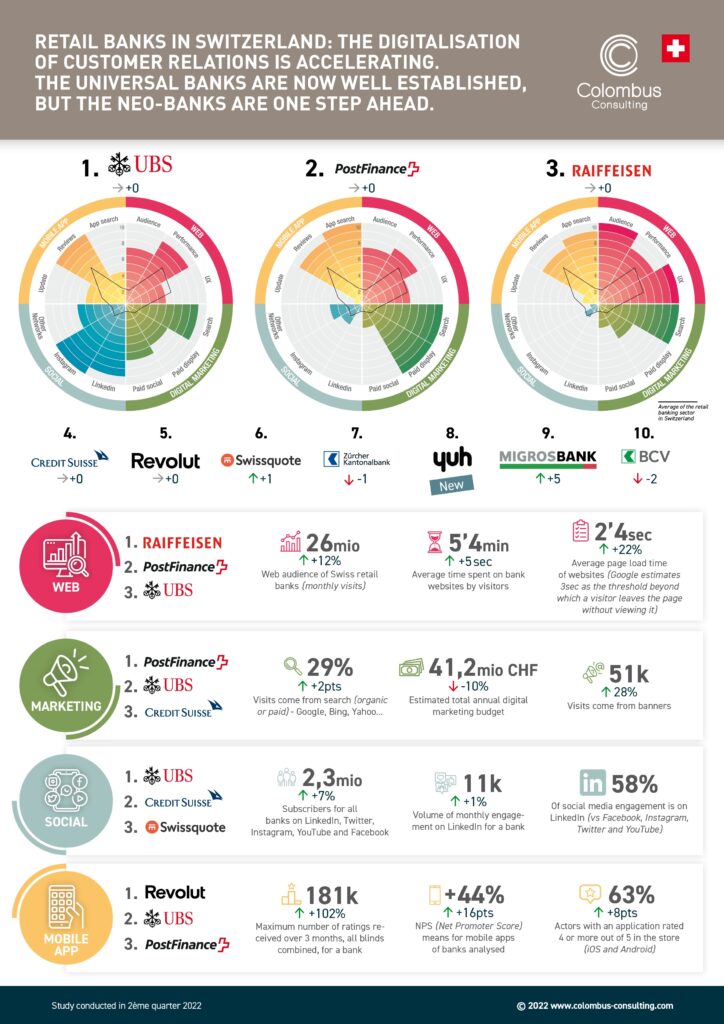

Major banks still dominate the ranking in 2022

After being heckled by challenger Swissquote, the big banks remain leaders in our ranking in this order: UBS, PostFinance, Raiffeisen, Credit Suisse. The arrival of Yuh, the result of a partnership between PostFinance and Swissquote, is one of the highlights of the 2022 ranking. The neo-bank makes a remarkable entry by overtaking Swissquote after only 18 months of activity, while remaining behind PostFinance. Although the ranking has changed little, there have been real developments in all the dimensions studied and growth in digital banking remains strong. A few figures illustrate this trend: the digital audience of Swiss retail banks is up 12% to 26 million monthly visits. The reach on social networks is also increasing and the number of subscribers has now reached 2.3 million in Switzerland (+7%).

Retail banks move closer to digital banks with hybrid services

With the emergence of neo-banks and new market needs, traditional banks have proposed more digital services this year, and even launched dedicated brands such as CSX (Crédit Suisse). CIC is the latest institution to enter this niche with CIC ON, offering a range of digital and personal financial solutions.

“New banking institutions have emerged in recent years, but to break into an ultra-competitive domestic market, innovation remains essential,” says Jean Meneveau, Associate Director of Colombus Consulting Switzerland.

Among the new developments, we can mention Yuh, which distributes Swissqoins (a crypto-currency from its parent company Swissquote) to develop the use of its services and build customer loyalty. An original approach that combines banking services and gamification.

Mobile applications driven by neo-banks

In just a few years, mobile applications have gone from being a simple showcase for customer services around e-banking, to a space that concentrates all the innovation in the banking sector. In this area, Revolut remains unrivalled, thanks in particular to specific functionalities such as temporary bank cards and instant payment, which compete head-on with Twint. The other major banks (UBS, PostFinance, Crédit Suisse) are following suit and making progress, although they have not managed to catch up. These institutions have historically favoured Twint, which has now become almost universal (nearly 80% of the panel).

Social networks: still growing, with LinkedIn in the lead

The growth is continuous on social networks. While everyone is looking for novelty on Tik Tok, the network is not very relevant to the banking sector, and only 20% of the banks on the panel have a really active account there. On the other hand, Linkedin takes a majority place on with 58% of the total engagement, all social networks included on the whole panel. The priority therefore seems to be to target active people in a serious context like LinkedIn, rather than a younger target in an offbeat context like Tik Tok. Social networks are also amplification media, with different priorities: traditional banks insist more on their ESG products and their CSR commitments, while neo-banks have a discourse more focused on new technologies and crypto-currencies.

Towards the digitalisation of banking services

Banks have invested more in digitalization since the pandemic, especially for account openings (for 2/3 of the panel). Although some banks still require customers to go through a number of physical steps, the development of an increasingly digital relationship is a priority, particularly for simple transactions, without replacing advisors for more complex operations. Indeed, the more conservative institutions are playing the proximity card and a more hybrid customer relationship between digital channels and face-to-face advisors. In any case, the challenge of omni-channel for traditional and digital banks remains paramount, with very different ways of looking at customer relations. “The key stages in the lives of customers (new projects, property purchases, insurance, etc.) are still often absent from digital channels, even though they are natural entry points for (future) customers,” concludes Jean Meneveau.

Will sustainability and ESG criteria become the new norm?

In the face of the climate crisis, ESG investments are naturally taking off, and are widely relayed by the banking sector. Sustainable development is thus becoming a normal part of the investment selection criteria for clients, who now demand this transparency. On this front, the most digital banks are lagging behind, putting forward new products with a technological dimension, notably crypto-currencies. The latter do not meet ESG criteria at best, even if greener crypto-currencies want to emerge … to make themselves more acceptable?

Digital Index: the sector’s overall digital performance

Columbus Consulting presents below the global ranking of the digital index, which measures the digital performance of retail banks based on 50 indicators divided into four areas: Web, Mobile, Marketing and Social.

Fill in this form to download our study