We have built this study based on measurements taken from November 2021 till February 2022 and on a panel of almost 40 Swiss watchmakers.

Richemont Group: Baume & Mercier, Cartier, IWC Schaffhausen, Jaeger LeCoultre, Länge & Sohne, Montblanc, Officine Panerai, Piaget, Vacheron Constantin, Van Cleef & Arpels

LVMH Group: Bvlgari, Chaumet, Hublot, TAG Heuer, Zenith

Rolex Group: Rolex, Tudor

Kering Group: Gucci, Ulysse Nardin

Swatch Group: Blancpain, Breguet, Longines, Mido, Omega, Rado, Swatch, Tissot

Others: Audemars Piguet, Breitling, Chopard, Franck Muller, Frederique Constant, Hermes, Richard Mille, Patek Philippe, Titoni, Victorinox

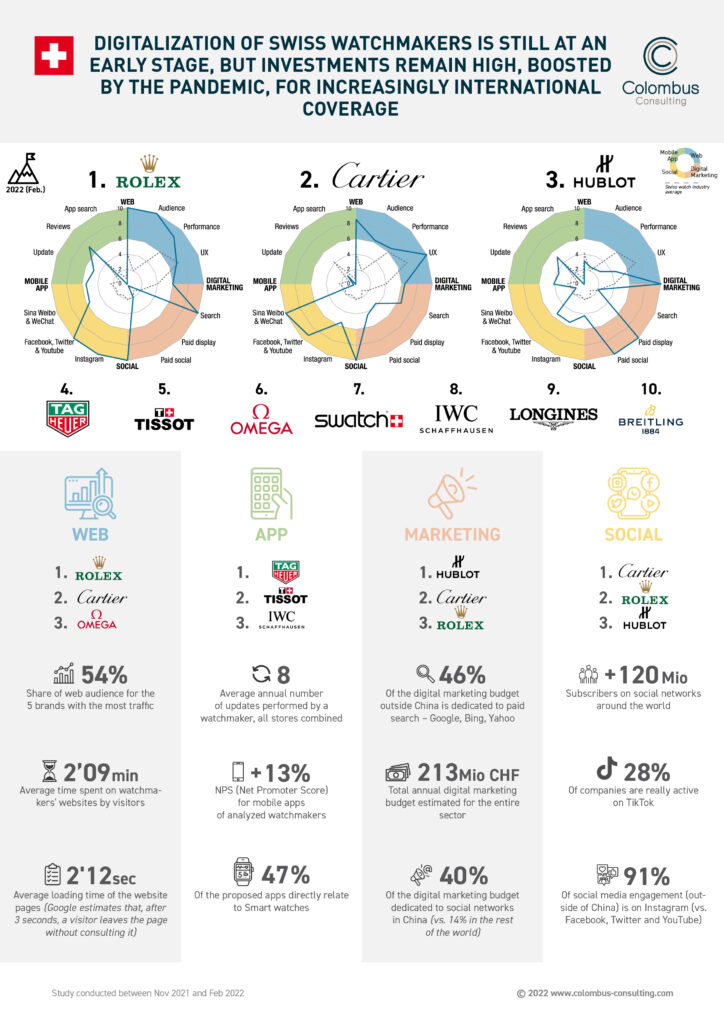

First observation: the web is becoming an important showcase

for watchmakers.

Their brand and purchasing experience continues to be primarily in-store despite the pandemic. The Internet allows them to get closer to their customers and the community with some services (appointment booking, watch content, etc.), but they still support the in-store experience. A

few players in the high-end watchmaking industry stand out, nonetheless.

Second observation: mobile apps are progressing slowly in

the wake of Smart watches.

Companies have only recently developed mobile apps, and their number and popularity remain limited. The few companies offering Smart watches

have, of course, had to develop a dedicated mobile apps to facilitate tracking and offer complete online services. Other digital services (warranty, communities) are slowly emerging to develop a direct relationship with end customers, regardless of the sales channel (own store, distributor, ecommerce …).

Third observation: digital media budgets are important.

Watchmakers are making massive investments in paid media.

The dynamics are also very different from one region to another, with different advertising ecosystems between Europe, the United States, Asia and China, as well as the particular importance of influencers.

The last observation: social networks are strong drivers of

engagement for customers and communities based around

their favorite companies.

In Europe and the US, Instagram has quickly become the leading network for engagement, and all companies have increased their presence. Tik Tok seems to be the next step, with some brands starting to successfully invest

in the network. In China, the ecosystem is completely different, with WeChat and Sina Weibo as the leading networks. The most successful companies are, of course, those who have a strong digital strategy in this region.

Our study shows that all watch companies have invested in digital channels, without abandoning their core values. Digital technology can enhance the customer experience, but it does not replace the in-store experience. The challenge of going digital is undoubtedly to reach new targets, offer new services, and understand the expectations of markets that are still affected by the pandemic, as well as the development of new

behaviors.