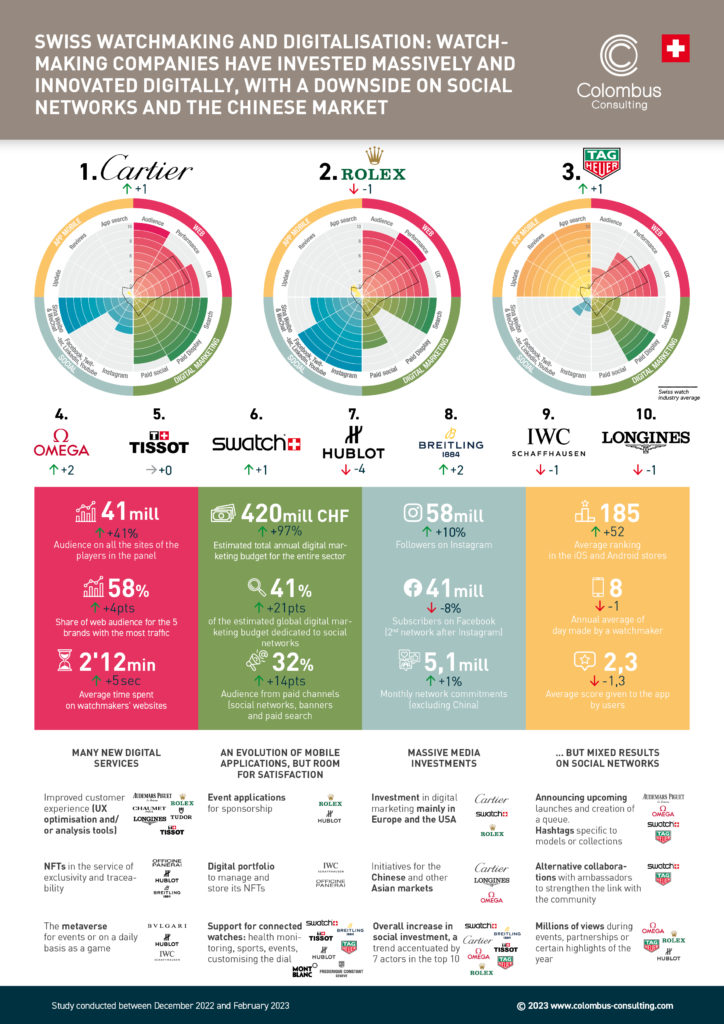

Swiss watchmaking and digitalization: watchmaking companies have invested massively and innovated in digital technology,

with a downside on social networks and the Chinese market

Colombus Consulting publishes its 2nd study on the digitalization of customer relations in the Swiss watchmaking sector:

– Cartier dethroned Rolex at the top of the global digital performance ranking of the 40 major players in the Swiss watch industry,

– The watchmaking houses have invested heavily, with a strong increase in their audience as a result,

– While overall growth in digital has been good, growth in social networks has been sluggish, particularly in the strategic Chinese market.

We have built this study based on measurements taken from December 2022 to February 2023 and on a panel of almost 40 Swiss watchmakers.

Richemont Group: Baume & Mercier, Cartier, IWC Schaffhausen, Jaeger LeCoultre, Länge & Sohne, Montblanc, Officine Panerai, Piaget, Vacheron Constantin, Van Cleef & Arpels

LVMH Group: Bvlgari, Chaumet, Hublot, TAG Heuer, Zenith

Rolex Group: Rolex, Tudor

Kering Group: Gucci, Ulysse Nardin

Swatch Group: Blancpain, Breguet, Longines, Mido, Omega, Rado, Swatch, Tissot

Others: Audemars Piguet, Breitling, Chopard, Franck Muller, Frederique Constant, Hermes, Richard Mille, Patek Philippe, Titoni, Victorinox

The ranking of watchmaking companies will change significantly in 2023, with Cartier becoming the leader

The study shows strong growth in digital activities: the web audience is increasing strongly (+40% compared to 2022), and annual digital marketing budgets have almost doubled to reach 420 million francs. While Rolex was the undisputed leader in digital in 2022, the other houses have closed the gap, with Cartier taking the lead in 2023.

Development of digital services beyond the website

While the brands are increasingly offering e-Commerce sales, digital services are diversifying through numerous initiatives: marketplaces for events (e.g., Breitling, Rolex, Zenith, Richard Mille), dedicated sites to reinforce communication on values, history of the brands or iconic models (e.g., Rolex, Cartier), as well as a focus on the performance of the sites and the experience offered via the adoption of behavioural analysis tools (e.g., Audemars Piguet, Chaumet, Longines, Omega, Rolex, Tissot, Tudor)

Half-hearted growth on social networks

Instagram remains the master network in the world of watchmaking. The growth is there (+10% for Instagram subscribers), but it is no longer uniform. Indeed, the second most important network for watchmaking companies is Facebook, which is decreasing by 8%, as is the Meta group, which is decreasing globally. Engagement, which remains the most important indicator for watchmaking companies, is down by 12% on all the social networks studied. Despite these declines, growth drivers exist, notably TikTok. Two-thirds of watch manufacturers have developed a community on this network by adopting its codes.

China’s attractiveness, but a lagging performance

The expected growth in the Chinese market, a major stake in the consumption of luxury goods and in particular prestige watches, is below expectations. The exit from the Covid-19 crisis is still complicated for the Chinese economy. Chinese consumers’ interest in the networks is nevertheless growing, with 11% more subscribers on Sina Weibo. Along with WeChat, these two leading platforms are focused on “social commerce” by offering a closed ecosystem where users go from discovery to purchase without leaving the application. Cartier, Tissot, Tudor and more recently Hublot are leaders on these networks in terms of volume of subscribers and engagement.

Digital Index: The overall digital performance of the sector

We present here the global ranking from the Colombus Consulting Digital Index, measuring the 360° digital performance of the Swiss watch industry according to 50 indicators (web, mobile, marketing and social). The results show very different situations between the players.