Colombus Consulting has published its 3rd study on the digitalization of customer relationship in the Swiss watchmaking sector:

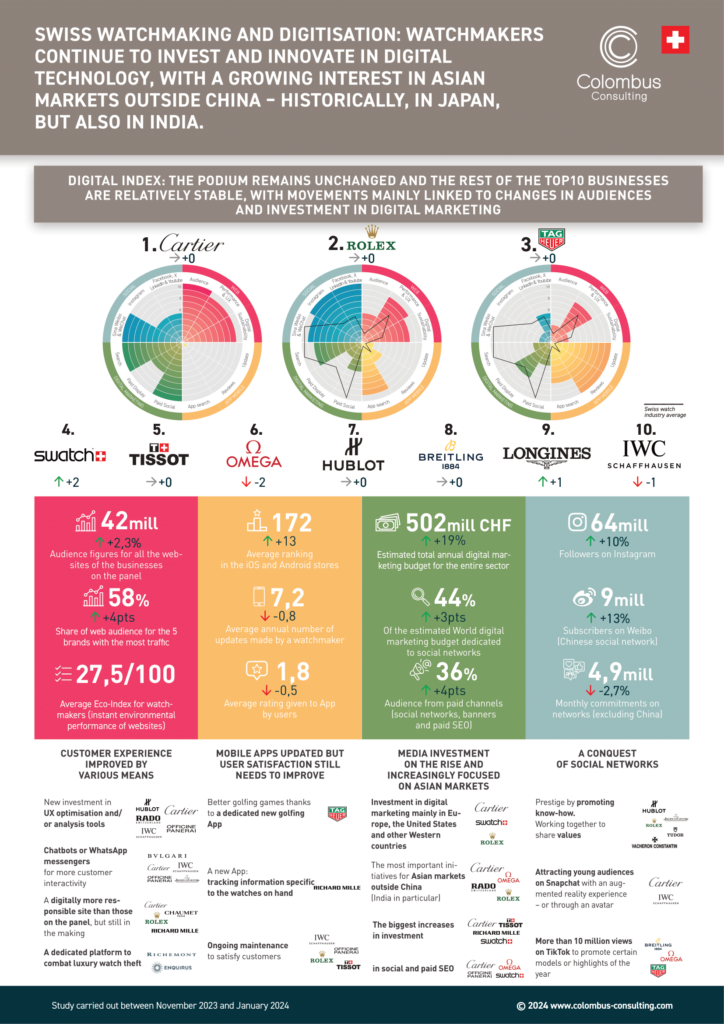

- The panel’s audience exceeds 42 million monthly visitors,

- Major investments are being made in Asia, where new markets such as India are emerging,

- After the disillusionment of metavers and NFTs, some initiatives are resisting.

Audiences are growing slightly in 2024, but investment remains robust

The panel’s audience exceeds 42 million monthly visitors (+2% compared to 2023). Some brands, such as Cartier and Vacheron Constantin, are making strong progress (double-digit growth), driven by Asia. On the other hand, other brands such as Rolex and Hublot are experiencing a decline in audience, mainly in Europe and the United States.

The digital media budget has risen sharply, exceeding CHF 500 million per year (+19%), with a preponderance for search engine optimisation and social networks.

Digital services that are less “gimmicky” and more focused on customer experience

Whereas in recent years digital services have focused on showcases (communication, history of the brands, iconic models, etc.), new services concentrate more on watches, with, for example, anti-theft functions (Enquirus from the Richemont group) and after-sales options (new App from Richard Mille). While the first mobile Apps seemed to explore different avenues, sometimes with a gadget effect, they are now focusing more on watch-related uses and services.

“This development in digital services is positive for the watchmaking sector, but feedback from users and customers is below that of other sectors, with a rather low average score on App stores (1.8/5). This shows a certain gap between expectations and user perceptions,” points out Jean Meneveau, Associate Director of Colombus Consulting.

Contrasting trends in social networks

The number of subscribers on social networks is growing (64 million for Instagram, up 10%), but monthly engagement is down (4.9 million, down 3%). Some brands are innovating by venturing onto networks with very specific codes: while Instagram remains the king network for watchmaking, this study notes several successful initiatives on Snapchat with IWC and Cartier, and on Tik Tok with accounts with several million subscribers for TAG Heuer and Hublot.

Chinese networks back in force

While 2023 was still marked by a recovery from the Covid-19 crisis, 2024 shows a new direction for this market, with clear growth in the Chinese digital ecosystem, still driven by Sina Weibo and WeChat. For many brands, such as Cartier, Officine Panerai, Rolex, Rado, Tudor and Vacheron Constantin, there will be sustained growth in subscriptions and mentions (between 15% and 50% compared to 2023).

After the disillusionment of metavers and NFTs, some initiatives are resisting

The somewhat wild craze for NFTs has died down. There are fewer projects based on this concept today, but they are undoubtedly better targeted: Frédérique Constant, for example, has launched an exclusive series in which an NFT can also be used to offer benefits and invitations to its customers.

Metavers, meanwhile, are no longer really in the news, and only virtual and augmented reality initiatives have survived. Its use in boutiques, trade fairs and events remains popular, as shown by numerous examples for Cartier, Officine Panerai and Richard Mille.

Lagging behind in generative AI?

The luxury sector remains a fervent believer in innovation, and companies are rapidly integrating technological advances. However, watchmakers seem somewhat reluctant to fully embrace generative AI. Their use is mainly focused on the design of new models and quality control, leaving aside analyzing their customers’ preferences.

“By leveraging generative AI on customer knowledge, watchmakers could offer ultra-personalized products and services, and respond even more precisely to the specific expectations and tastes of their demanding customers.”

Neglected digital responsibility

The evaluation of responsible digitalization has been added to our study. It shows a lack of attention from the panel as a whole. While Cartier, Chaumet, Richard Mille and Rolex all scored well above average, there is still considerable room for improvement in terms of eco-designed websites, which would support an environmental and social approach already adopted by several manufacturers in their models and collections.

2024: The emergence of India?

This study reveals stronger customer bases from the Asia, with consolidation of the historic Japanese market (Cartier, Swatch, Rolex) – but also the emergence of a new giant for the watch market: India, for which Rolex, Rado and Omega boast the largest web audiences. At the start of 2024, the audience in this country is growing rapidly, and watchmaking executives anticipate that this market will have a growing impact on their sales. The Chinese market, which resumed its role as the driving force behind sales last year, could stagnate or even decline in 2024, redefining strategic priorities in the watchmaking sector.

Digital Index: The overall digital performance of the sector

We present here the global ranking from the Colombus Consulting Digital Index, measuring the 360° digital performance of the Swiss watch industry according to 50 indicators (web, mobile, marketing and social). The results show very different situations between the players.

Methodology

We based this study on measurements taken between November 2023 and January 2024 on a panel of 38 major players in the Swiss watchmaking sector.

Richemont Group : Baume & Mercier, Cartier, IWC Schaffhausen, Jaeger LeCoultre, Länge & Sohne, Montblanc, Officine Panerai, Piaget, Vacheron Constantin, Van Cleef & Arpels

LVMH Group : Bvlgari, Chaumet, Hublot, TAG Heuer, Zenith

Rolex Group : Rolex, Tudor

Kering Group : Gucci, Ulysse Nardin

Swatch Group : Blancpain, Breguet, Longines, Mido, Omega, Rado, Swatch, Tissot

Others : Audemars Piguet, Breitling, Chopard, Franck Muller, Frederique Constant, Hermès, H. Moser & Cie, Richard Mille, Patek Philippe, Titoni, Victorinox

We offer a digital index to measure operators’ 360° digital presence and performance, based on 50 indicators:

- Website : audience, performance (bounce, visit time, loading time, core web vitals), customer experience (design, content and features) and digital responsibility (EcoIndex)

- Mobile apps : updates, comments and ratings, NPS (Net Promoter Score), referencing in stores

- Digital marketing : search engine optimization, display, email, social networks, partners

- Social networks : Facebook, Youtube, X (ex-Twitter), Instagram, LinkedIn, WeChat, Sina Weibo

Solutions used:

We used various market data collection tools. We reworked all the data in the form of an index for a simple, visual benchmark of the sector. The solutions we chose were : Decodeapps, Alexa, Similar Web, Semrush, Built with, Google, PageSpeed Insights, EcoIndex, WeChat, Sina Weibo.

To find out more, have a look at our Luxury and Customer Value offers.